What is the AU LIT Credit Card?

The AU LIT Credit Card from AU Small Finance Bank is more than just a standard credit card. It’s a “Lifestyle in Tune” (LIT) product crafted to provide a seamless experience for individuals looking for flexibility, savings, and rewards. The AU LIT Card lets you customize benefits to match your spending habits, offering a personalized credit experience that is truly unique.

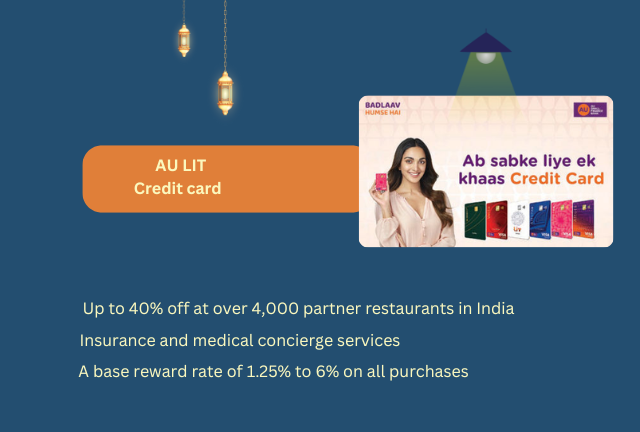

Benefits of the AU LIT Credit Card

The AU LIT Credit Card offers an array of benefits, setting it apart as a versatile and valuable choice. Here’s what you can expect:

- Flexible Benefits: With the AU LIT Credit Card, cardholders can choose the benefits they want, tailoring their card experience to best suit their lifestyle.

- Reward Points: Earn reward points on every transaction, which can be redeemed for discounts, gift vouchers, or exclusive perks.

- Cashback on Essentials: The card offers cashback on essential categories like groceries, dining, fuel, and more, making it a great choice for everyday savings.

- No-cost EMI Options: For big purchases, the AU LIT Card provides no-cost EMI options, making it easy to manage larger expenses without a financial burden.

- Complimentary Lounge Access: Enjoy access to airport lounges, adding comfort and luxury to your travel experience.

- Fuel Surcharge Waiver: AU LIT Credit Card users benefit from a fuel surcharge waiver, easing the cost of fuel purchases.

These benefits make the AU LIT Credit Card a solid choice for those who want rewards and flexibility, all while managing their expenses effectively.

Understanding AU LIT Credit Card Charges

While the AU LIT Credit Card offers significant benefits, it’s important to understand the associated charges to make the most of this card. Here’s a breakdown of the key fees and charges:

- Annual Fee: The AU LIT Credit Card comes with an annual fee, which may vary depending on the customization and features chosen.

- Interest Rate: Competitive interest rates apply to outstanding balances, but you can avoid interest by paying your balance in full each month.

- Late Payment Fee: To encourage timely payments, a late payment fee is charged if payments are not made by the due date.

- Foreign Transaction Fee: For international purchases, a nominal foreign transaction fee applies.

- Cash Advance Fee: A cash advance fee is charged for ATM withdrawals, and interest may start accruing immediately on cash advances.

Understanding these fees can help you make informed decisions about using the AU LIT Card for various transactions, optimizing its benefits while managing costs.